Can you feel the real estate market turbulence? Have you heard that we’re headed for a recession?

According to a survey by our good friends at Zillow (who are never wrong, right?) and Pulsenomics, the breaking news is that we can expect it to hit “sometime in 2020, most likely in the first quarter,” says Market Watch personal finance reporter, Jacob Passy.

Slightly less than half of the 99 panelists surveyed predicted a 2020 recession, which echoes a June survey by the National Association for Business Economists and another by the Wall Street Journal.

Where they diverge, however is that most of the NABE’s panelists don’t expect the recession to begin until the end of 2020. Eighteen percent of them think it’ll happen in 2019.

Never mind that none of these economists pegged the oncoming Great Recession.

“It’s not just that they missed it, they positively denied that it would happen,” according to Wharton finance professor Franklin Allen at upenn.edu.

In fact, right before the onset of the Great Recession, ALL of the Blue Chip 50 economists said that we could expect “solid growth” for the following year.

Yet the media is all-in on believing them this time around, despite the sketchy source.

For a real estate website that won’t let you down, be sure to consider LeadSites.

Ok, we’ll play

What will you say to your clients and potential clients when they don’t want to do real estate right now because they’re feeling the real estate market turbulence? First, explain how wrong these economists were the last time around. Then, offer them the following advice.

Can’t fault the housing market this time

It won’t be a crashed housing market that causes the forecasted 2020 recession, according to the economists surveyed by Zillow. Their experts expect it to be triggered by slow growth, prompted by the Federal Reserve’s raising “short-term interest rates too quickly,” according to Passy.

They also worry about a stock market correction and higher than expected inflation.

The NABE’s panelists say that the expected 2020 recession will most likely be triggered by a trade war, owing to the president’s trade policies – his tariffs, specifically.

So, how does this calm your clients’ nerves?

There will be no housing bubble to explode in their faces, according to the experts. Remind them that not all recessions have been like the last one and that a recession doesn’t automatically equal a housing crisis.

Get in touch with your clients with Contact Me – You’re always just a button push away. Learn More.

Homeowners shouldn’t worry about real estate market turbulence

At least according to the experts, homeowners should ride out this real estate market turbulence quite well, especially those who refinanced into a lower mortgage rate and were able to get more affordable monthly payments.

They’re also sitting on a whole you-know-what load of equity right now – equity that isn’t likely to dissipate during the forecasted recession.

Huh?

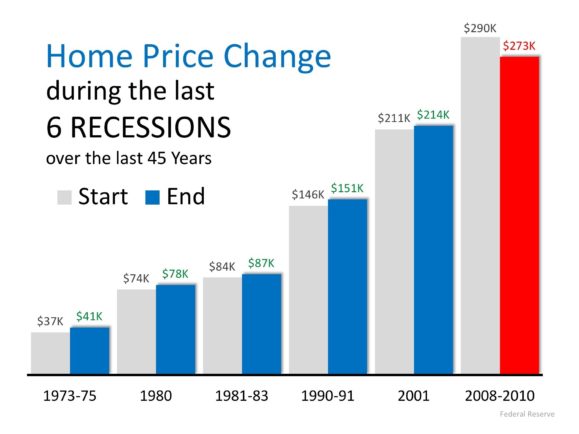

During the five recessions prior to the Great Recession, home prices actually increased.

Overall, the housing market is so strong right now that it is likely to weather a little real estate market turbulence, according to Mark Fleming, chief economist for First American Financial Corporation (parent to First American Title).

He thinks, in fact, that “the housing sector should be one of the leading sources to come out of the recession,” according to an interview at usnews.com.

What to watch for

Keep an eye on crude oil prices. “A big increase in oil prices has preceded nearly every U.S. recession since World War II,” according to the St. Louis Fed in a blog post titled “What Does the Fed Look at to Predict Recessions?”

The post goes on to list other patterns around a recession:

- “Asset bubbles” swelling, such as the dot-com mess before the 2000 recession and the popping of the housing bubble before the Great Recession.

- An inverted yield curve, which has preceded all recessions since 1960, they said. The trigger is pulled when “interest on a short-term debt (say, three-month Treasuries) is higher than the interest on a long-term debt (say, 10-year Treasuries).”

If we listen to the experts, your clients have nothing to worry about when it comes to the real estate market. Don’t let them buy into the media hype and you’ll keep them in the market.

Want a website that communicates trust and expertise? Learn more about LeadSites, and see how you can get started today.

Dominate your market with over 200 real estate marketing tips!

Lead generation is constantly changing. How do you generate more leads in 2018? Be sure to watch the video below:

The post How To Calm Your Clients’ Fears About Real Estate Market Turbulence appeared first on Easy Agent Pro.

from theokbrowne digest https://www.easyagentpro.com/blog/real-estate-market-turbulence/

No comments:

Post a Comment